Where are you from in the company again?

Too many technology organizations promote from within—product managers, solutions consultants or outstanding support persons. This behavior has pluses and minuses. The pluses are evident—those employees know the product, the market, and they understand how the product is actually used versus how the product is marketed.

While technology DNA abounds in most product management organizations, the soft spots often emerge when it comes to managing a business. Ultimately, product management isn’t about delivering features, it’s about bringing profitable products to market.

Marketing metrics

How often is a product manager asked about average unit price of a given product, profitability of the product group or cost of support? How many product managers are forced to piece together anecdotal data from multiple systems in order to {fill in the blank}?

Practicing product management with partial data sets is the norm. In many organizations, Product Management’s view of the data is different than Support, which is different than Sales, and definitely different than Finance. So where do you start?

The best place to start is Finance because they typically use the same numbers the board of directors use to validate your product’s performance. While the finance team may not have all the data a product manager needs, their numbers are what your organization ties back to, not that of Sales and Support.

Got to know your numbers

Microsoft Excel spreadsheets are everywhere; what’s a product manager to do? It’s not just the numbers that you work from, but also the way you work the numbers to deliver value for your CFO. There are effectively two kinds of CFO’s—strategic and non-strategic. One’s a leader; one’s a bean counter. It’s a shame. Finance is supposed to be about the strategic use of money, but too often, only focus on counting the top-line dollars.

Do you have a strategic CFO or a tactical bean counter? This very much depends not only on how the CFO behaves, but also the leadership team and the rest of the business. If you expect a bean counter that creates pretty Excel tables, which are essentially scorekeeping for the CEO and board of directors, then that is what you get. Give the CFO an opportunity to contribute, participate in the day-to-day workings of your product as a business, and you may just get a business partner who can help you and your product be more successful in the marketplace.

Litmus test

Conducting a litmus test to determine whether your CEO is a bean counter or a strategic leader is fairly simple. The following questions and answers directionally identify which type you might be working for:

Q How many customers abandoned the product last year versus new buyers?

Bean Counter We lost 2% revenue.

Strategic CFO You lost 4% of your customers, which is 2% of the revenue. Can you help find out how we might accelerate this trend with other customer segments?

Q What was the average deal size last quarter? Is it lower than the previous quarter?

Bean Counter We did better last quarter than the previous quarter in number of deals and bookings.

Strategic CFO The average deal size has gone down, but we closed more deals and bookings. Can you find out why and what is the change in the deals?

Q What was the gross margin of new customers last year?

Bean Counter Your P&L was running at 68% gross margin.

Strategic CFO Your new customers are at ~62% gross margin or dilutive to the rest of the business. Check with Support to see if there are new things driving up costs and work with Sales to see if we are still selling that product? It has a steep learning curve for customers and drags down the business.

Yes, the strategic CFO wants to know more and if you bring back the right data, you gain a partner at the company. The challenge is if you have a strategic partner, you need some basic skills, not just so you don’t get buried in the boardroom, but so you can speak less marketing and more finance and even more business. In this article, we use every-day concepts and regular speak to demystify the wonders of finance, at least enough to help a product manager gain the basic modeling skills so you aren’t discredited when you go back with the answers.

Product management is all about getting your organization to make the best business decisions—to achieve monthly, quarterly, and annual objectives. Good decisions are based on information—not data. A spreadsheet containing summary product line bookings by month is data. Understanding the key drivers behind monthly sequential changes or year-over-year changes is information. Technology companies tend to get lost in their data. Differing political factions in the company often try to use point pieces of data to justify their positions or tear down their opponents’ positions. Strategic CFOs have seen this game played before and recognize that at the end of the day, it rarely moves the business forward.

The strategic CFO plays the role of translating data into actionable information. Help your CFO and the entire organization become more strategic by adopting strategies and techniques that automatically translate data into information that can be applied on a daily basis.

Strategic product managers should add the following four proficiencies to their repertoires.

- Financial literacy

- Flux analysis

- Tier analysis

- Money wheel analysis

Increasing your skills in these four areas enables you to help the CFO and your company become more strategic and effective in the marketplace.

Financial literacy

Typically, at best, most product managers have a superficial understanding of basic financial concepts. While product managers may know a few of the financial terms, they generally struggle to apply the terms in business situations to explain or justify the financial value of a specific product, service, or proposal. How many times in the past quarter have you heard your sales team say a prospect “just didn’t see the value” in acting now. How many times have you heard your marketing team say “we’re surprised that the campaign generated such little interest—you’d think in these tough economic times any company would want to save money by using our solutions.”? CFOs see the world through numbers, financial statements, and cash flow. If you cannot speak their language, how will you ever become a strategic asset to them? How can you honestly deliver a compelling ROI statement for your product if you can’t find your way around an income statement or a balance sheet? In fact, financial illiteracy costs technology companies far more than they care to admit.

Here’s a simple case in point. A technology company had a long-standing relationship with a customer in which they provided a value-added outsourced solution that cost over $1.5M a year. After a change in management, the customer decided to re-examine its investment in the outsourced solution. A new executive wanted to bring the solution in-house. To do so, the company would have to invest over $750,000 in equipment and software, plus set up a group of employees to do the processing/value-added services that the service provider had been doing. The company believed that bringing the business in-house would save $500K a year. The salesperson on this deal was afraid the customer would take the solution in-house. As a result, he offered to cut the monthly fees by 50% so the customer would not even consider taking the solution in-house. With the price cut, the new executive would be able to claim $750,000 in savings. He would be a hero and the company would still have a customer.

Fortunately, a product manager supporting the deal did a little research about the customer. Even though it was a large company with greater than $200M in revenue, it had serious financial challenges. At the time they considered in-sourcing the solution, the company only had $5M in cash on their balance sheet and a limited revolving credit facility. Once the sales team realized the company would have to invest about 20% of their existing cash balance to make the project work, they realized the customer had not been serious about in-sourcing. Instead, they were really looking to get a massive price reduction. Armed with this knowledge, both parties were able to structure a win-win deal that did not result in a 50% revenue reduction. This is a classic example of how financial illiteracy can directly impact your top and bottom lines.

Product managers should be able to:

- Locate financial statements and public SEC filings on the web

- Read and interpret, at a high level, income statements, balance sheets, and cash flow statements

- Extract key tidbits from 10-Qs, 10-Ks, and proxy statements of public companies

- Interpret key statistics about company performance and valuation

Apply this information on a daily basis to help better position the value of your products in context of your customer’s business. If your financial literacy is a little low, admit it, and get some help. Talk with your CFO and see if you can get a few key members of his/her staff to create a basic financial literacy program. Having them teach the fundamental language of finance ensures you are all using the same vocabulary and are on the same page.

Flux analysis

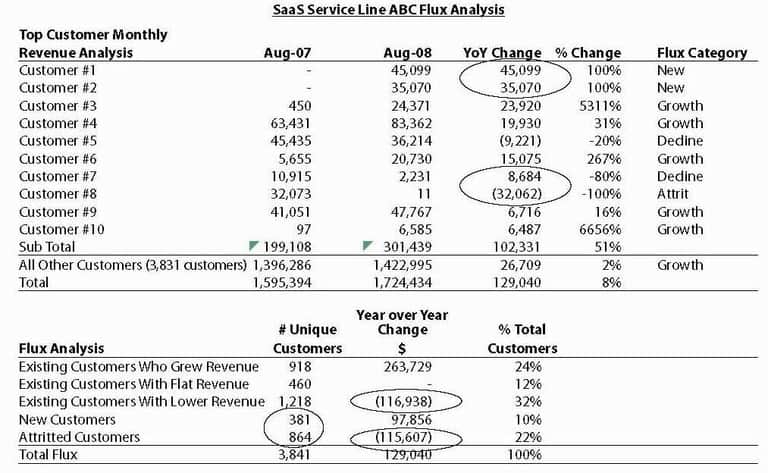

Flux analysis is an example of how you take basic revenue data and turn it into actionable information. Almost all software technology companies have at least one or more software as a service (SaaS) offerings. SaaS requires different analytical techniques than traditional licensed software products. Flux analysis helps organizations understand the month-to-month revenue changes in a SaaS product line from a customer behavioral perspective. If you understand the dynamics of your customer base’s behavior, you can identify and implement tactics to reinforce positive trends and mitigate the impact of negative trends. Take a look at the model above.

There are dozens of actionable takeaways from this analysis. The key thing is that the analysis puts the complex dynamics of monthly SaaS customer behavior into a context that the entire team understands. Strategic CFOs intuitively discern these changes based on their experience. By adopting this type of value-added analysis, you can elevate the analytical skills of your team and the company. Now when you talk about growing your business, you can focus on real drivers and not spend hours arguing about data.

A word of extreme caution: Anytime you present financial information—revenues, COGS, operating expenses, EBITDA—you must ensure your numbers exactly match the numbers in the finance reports. Finance is the official scorekeeper and you must reconcile your numbers with theirs. Otherwise, you’ll never be able to defend the accuracy of your analysis and the validity of your recommendations. Everyone else in the business will lob hand grenades in your direction, simply because you failed to spend 15 minutes ensuring your total revenue number matched what finance reported.

Flux Analysis

Turn basic revenue data into actionable information

Tier analysis

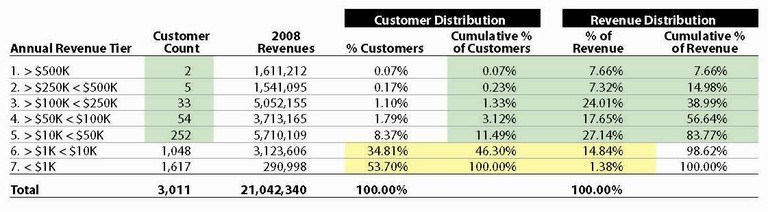

Tier analysis is a tool that should be in every product manager’s toolkit. Tier analysis categorizes customers into groups based on their annual revenue contribution to your business. The reality is not all customers are created equal—some contribute significantly more to the business while others contribute significantly less. You need to protect, defend, and grow the critical customers while providing the smaller customers with an appropriate level of service. Take a look at the tier analysis below.

This type of analysis helps a product manager understand and justify providing differentiated service to specific customer segments. You can extend this type of analysis by combining it with the flux analysis mentioned above.

Tier Analysis

Categorize customers into groups based on their annual revenue contribution to your business

Money wheel analysis

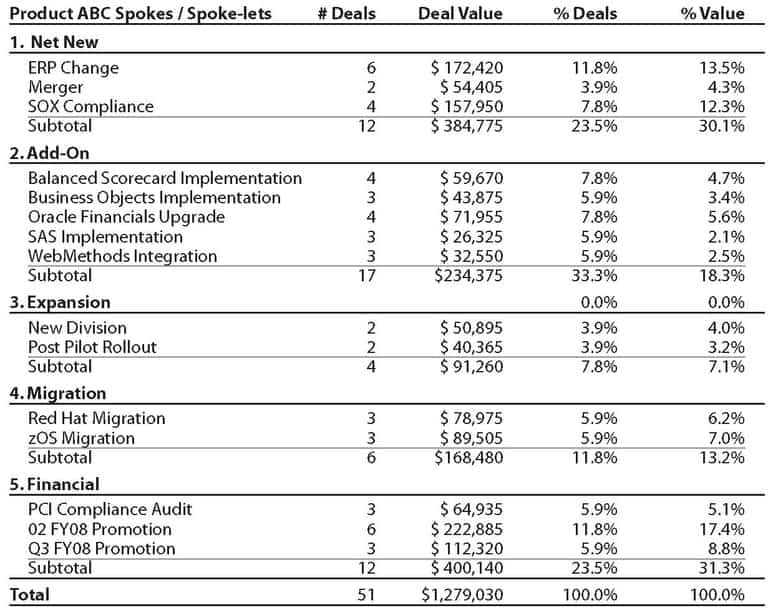

Strategic CFOs understand that the most successful technology sales forces leverage repeatable sales transactions to scale revenue. The money wheel is an analytical tool that technology companies can use to discover the most effective, repeatable sales transactions in their markets. Take a look at the table below that summarizes a quarter’s sales transactions for a particular product.

A money wheel has two major components: Spokes & Spoke-lets. Money wheel spokes identify the categories of repeatable sales transactions that occur within a product/service line:

- Net New Customers organizations that have never purchased from your company

- Add-On Sales existing customer buying an add-on product/service to support use of an existing product/service

- Expansion Sales existing customer buying more seats/copies/users

- Migration Sales existing customers paying to migrate from one product version to another

- Financial Transactions financially driven sales transactions. Examples include 3-year prepaid maintenance deals with significant discounts or an add-on product bundled so that some license revenue can be recognized. Includes conversion from term to perpetual software licenses, disaster recovery licenses, etc.

Spoke-lets are the types of repeatable sales transactions within a specific money wheel spoke. A spoke-let answers the question: “Why did someone wake up this morning and decide they needed to buy a new software solution?” There are lots of ways to refine a money wheel analysis. If you sort the spokes/spoke-lets by salesrep and region, you can obtain a much better understanding of why certain reps and regions are consistently more successful than others. You can also sorts the spokes and spoke-lets vertically to see where your ‘horizontal’ solution is getting the most traction. By understanding the distribution and drivers of sales transactions, you can identify patterns that your sales team can leverage.

Money Wheel Analysis

Summary of a product’s quarterly sales to discover the most effective, repeatable sales transactions in the market

Real numbers, real knowledge

We recognize the above analyses may not be considered the baseline requirements for financial literacy, but they should be close. If you have this type of information at hand, not only will operational reviews go better, you will improve your product’s position in the marketplace and your strategic partnership with the CFO.

Authors

-

John Mecke, with 39 years of experience, is an execution-focused operations and product management team player. His impactful career spans roles at KnowledgeWare, Sterling Software, and Saba Software. John's expertise extends across industries, including positions at EasyLink Services and Stonebranch. A dedicated professional, he brings valuable insights gained from diverse experiences. For questions or inquiries, please contact [email protected].

View all posts -

With 30 years of expertise in Product Life Cycle Management, Jon Gatrell has left an indelible mark at institutions like Eastern Michigan University, Jackson College, and companies such as Harbinger Corporation, Inovis USA, Stonebranch, UC Irvine, and Pragmatic Institute. He has also contributed significantly to ProductStart.io and Loren Data Corp. For questions or inquiries, please contact [email protected].

View all posts