7-minute read

Ethical pricing strategies weigh the impacts of pricing on consumers, producers and the overall market. Rather than solely maximizing profit or market share, ethical pricing balances business objectives with fairness, transparency and long-term customer trust.

Ethics is about being fair. Pricing is about capturing as much value from your buyer as possible. When sellers balance fairness and value, they use ethical pricing strategies. Let’s explore the difference between ethical and unethical pricing strategies and identify the hallmarks of each.

Let’s explore common pricing strategies and provide examples of ethical issues in pricing decisions.

What is ethical pricing?

Ethical pricing is a pricing strategy that weighs the price’s equality, integrity, and influence across all relevant players. These players include producers, consumers, suppliers, and workers. Ethical pricing strategies help understand and limit a single company’s pursuit of market share and revenue when those goals conflict with the well-being of the other relevant players.

Why are pricing ethics important?

Pricing ethics and implementing ethical pricing strategies are important because they keep companies accountable to moral and community standards. With ethical pricing, these companies must balance financial and growth goals with the well-being of their customers, workers, and the broader market.

What is an example of ethical pricing?

Most of the time, pricing handled ethically. In an average transaction, both parties enter it willingly and are better off after the transaction. That seems ethical.

For example, say a company makes a product that costs $100 to build. It will only sell its product at a price over $100. A buyer has a problem that the product solves, costing her $500. She will only buy at a price below $500. At any price between $100 and $500, both parties are better off if the transaction occurs.

The example above illustrates fair and ethical pricing. However, there are many instances of unethical pricing.

Examples of Unethical Pricing

During recent times of inflationary pressure, some companies hid predatory pricing tactics behind inflationary pressure. Among these tactics, some companies reduced the size of their products without disclosing this to the consumer while increasing the price. When record profit statements were made public, the unethical pricing tactics came to light. Another recent example occurred during a 2024 antitrust trial involving grocery giant Kroger when a top leader admitted that the company gouged prices above inflation.

Pricing Strategy Ethics

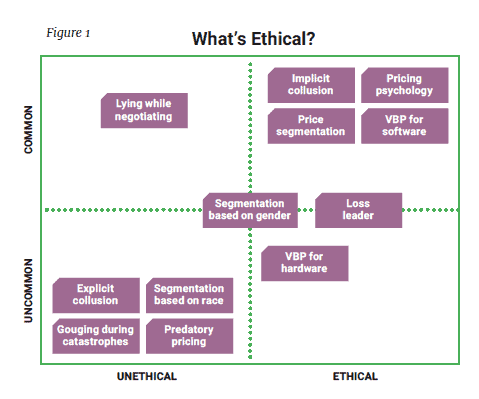

However, there are many unethical pricing tactics and strategies. Figure 1 plots those tactics on a chart to show how common they are compared to how ethical they seem.

Common, Ethical

- Implicit collusion

- Price segmentation

- Pricing psychology

- VBP for software

Common, Unethical

- Lying while negotiating

Uncommon, Ethical

- VBP for hardware

Uncommon, Unethical

- Explicit collusion

- Segmentation based on race

- Gouging during catastrophes

- Predatory Pricing

Other

- Segmentation based on gender

- Loss leader

Now, let’s explore some elements of ethical and unethical pricing strategies.

Ethical Pricing Strategies

The following are common ethical pricing strategies. Many of these you experience regularly with the services you rely on.

Pricing Segmentation as a Strategy

Price segmentation is a common practice that is defined as charging customers different prices for the same or very similar product. The goal of this strategy is to increase profitability by aligning prices with different segment’s willingness to pay while still maintaining the perception of value and fairness.

We see price segmentation every day, such as in streaming services. Many of these have no and low-cost plans with ads, while premium plans offer no ads but come at a higher price point. This allows casual viewers to watch for less, while those who value the experience of viewing with no ads have the ability to pay for that service.

Price segmentation isn’t always ethical or legal. Segmenting prices based on race, gender, disability status, religion, or nationality can be unethical and charging different customer groups different prices for identical products is unethical and may violate federal policy in the U.S.

It is legal, however, to charge different prices for similar products and market those products to different customer segments. For example, gender-based pricing, known as the “pink tax,” occurs when companies charge a higher price for a product stereotypically marketed toward women, such as a pink razor (compared to a blue razor marketed to men). While this is technically legal, many consider it an unethical pricing segmentation strategy.

Psychology in Pricing Strategy

Psychology in pricing utilizes the cognitive biases and mental shortcuts we use to make decisions quickly. For example, pricing strategists commonly assume that consumers tend to round down prices that end in .99. So when we see $20.99 we round this down to $20 and not up to $21. Ultimately, this pricing tactic has a relatively small impact on buyer behavior compared to other thought processes that lead to purchases, such as weighing needs and wants, pricing and resources, marketing over time, and other factors.

However, recent research has demonstrated that customers who struggle to process and understand numbers perceive .99-ending prices differently than customers who can process numbers easily. Customers who struggle with math might perceive $18.99 as a better deal than another customer. Considering that this pricing might capitalize on customers’ cognitive abilities or educational backgrounds, this pricing strategy might veer into an ethical gray area.

Unethical Pricing Practices

The following are examples of pricing strategies that are unethical, or in some instances, illegal.

Collusion as a Pricing Strategy

Collusion in pricing occurs when two or more businesses work in secret to coordinate their pricing strategies. Companies do this to manipulate the market, restrict competition and maximize their profits. This occurs at the expense of consumers, who are left paying higher prices because companies are no longer competing for their business, but running up prices behind closed doors. There are different forms of collusion, such as price-fixing, bid-rigging or market allocation. In general, these each tend to artificially inflate prices and limit the number of choices people have.

Collusion is not only unethical, it’s not legal. When companies collude, there is no longer free and open competition. Consumers are left paying whatever prices companies secretly decide upon, and they can raise the price at will because there is no lower-costing alternative on the market.

Pricing Strategy: Predatory Pricing

Predatory pricing occurs when a company uses its dominant position in the market to price its product below cost to drive competitors out of business. Once competitors are gone, the predator is free to raise prices. In theory, if a company raised prices to monopolistic levels, new competitors would enter the market with lower prices, stabilizing prices overall. This doesn’t necessarily happen, but even if it does, it can take years for a new competitor to enter the market. During this time, consumers are left with no choices and at the mercy of a single company that can raise prices at will. In some instances, predatory pricing could violate antitrust laws.

Pricing Strategy: Gouging

Price gouging may be consumers’ most hated pricing behavior. It occurs when a seller spikes the prices of goods, services, or commodities to an exploitative level higher than is considered reasonable or fair. For example, during the early days of the COVID-19 pandemic, when consumers were desperate for protection against the new virus, bottles of hand sanitizer were sold for as much as $250. You’ve likely heard of companies raising the cost of water during natural disasters. These are all examples of price gouging.

Price gouging can be challenging to identify in some industries, like the pharmaceutical industry. Let’s take a life-saving new drug as an example. If this drug saves 1,000 people and costs $1,000,000 to develop and produce, essentially, that drug costs $1,000 per person. However, that $1,000 per person does not cover research and development, trials and marketing costs. To cover additional costs and generate a profit, the company charges $2,000 per person. This type of price increase to generate profit is common and can be considered ethical within reason.

Conversely, consider the EpiPen. The price of an EpiPen went from $100 in 2007 to over $600 in 2016. Mylan, the maker of EpiPen, had increased the consumer price without experiencing an increased cost for its production and sale. Indeed, Mylan was ordered to pay $264 million to settle a lawsuit regarding this alleged price gouging. Radically increasing prices for a life-saving treatment simply to increase profits is unethical.

Ethical pricing builds trust, fosters long-term customer relationships and supports sustainable business growth. When companies prioritize fairness and transparency, they create loyal customers that come back time and time again. On the other hand, unethical pricing erodes trust, damages reputation and drives customers away. By recognizing and avoiding those practices, businesses can ensure lasting success while maintaining integrity in the market.

Author

-

Mark Stiving, a renowned Author, Speaker, and Pricing Expert with 41 years of experience, has made impactful contributions at various companies, including ONEAC, Advantest, LTX Corporation, Pragmatic Institute, and Impact Pricing. Widely recognized for his expertise in uncovering hidden value and maximizing profits, Mark has become a sought-after figure in the industry. For questions or inquiries, please contact [email protected].

View all posts