Background

Netflix is one of the largest streaming services in the world, with over 230 million subscribers. The company was founded in 1997 as a DVD-by-mail rental service. In 2007, Netflix launched its streaming service, allowing users to watch TV shows and movies on their computers. Initially, the streaming service was offered as a free add-on for DVD rental subscribers, but in 2010, Netflix began offering its streaming service as a standalone service.

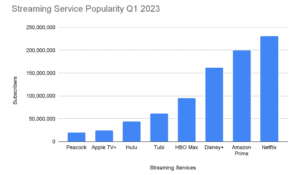

Netflix mainly competed against Amazon Prime (September 2008) and Hulu (October 2007) for market share in the first decade after they launched streaming. However, in the last five years, some of Netflix’s biggest competitors today entered the market, including Disney+ (November 2019), AppleTV+ (November 2019) and HBOMax (May 2020).

The influx of new services launched the “streaming wars,” and they slowly started chipping away at Netflix’s goliath-sized market share. In fact, in the first quarter of 2022, Netflix lost more subscriptions than it gained for the first time in 10 years. The company lost 1.2 billion subscribers by the end of Q2 last year.

While these streaming services don’t have as many subscribers as Netflix, they are growing fast and pose a real threat to Netflix’s potential growth.

The Problem

Account sharing has been a long-standing issue for the company, with over 100 million households estimated to be sharing accounts. There are even some state and federal laws designed to address the problem.

In 2011, Tennessee passed a “Login Law” that makes it illegal to share passwords to sites like Netflix and iTunes.The Computer Fraud and Abuse Act (CFAA) prohibits sharing passwords and can be considered a federal crime. However, enforcement is rare.

As Netflix continues losing prospective and current subscribers to other streaming services, they are concerned that password sharing could limit their growth in ways detrimental to their longevity.

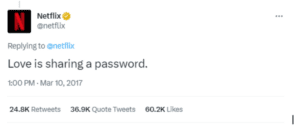

However, at times, password sharing was embraced by the platform and largely overlooked.

Now, the company is looking to reverse its stance on password sharing. As a result, they are pursuing revenue growth at the expense of revenue retention.

A Business Problem, Not A Market Problem

The market likes the relaxed password-sharing approach because many people flocked to Netflix when it first launched for convenience and affordability. Netflix wants to protect its revenue stream and increase its market share.

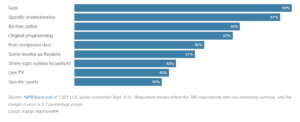

NPR conducted a recent survey asking what users want from a streaming service. Their top concerns were cost, ad-free options and original programming.

But Netflix isn’t focusing on the market needs, and in some cases, is doing just the opposite of what the market wants:

- Subscription fees increased in January 2022 (from $14 to $15.50 for the standard plan). And they’ve offered a new ad version at a lower cost.

- In 2023, Netflix plans to reduce the number of originals released.

- They plan to phase out 30-day free trials.

- Netflix has no interest in live TV or live sports.

- Netflix has also canceled several popular shows.

And most notably, they’re cracking down on sharing logins outside the household.

“They are taking the easiest path to increasing revenue, but they are not solving a market problem. In fact, they might be creating a market problem, which could backfire, resulting in them losing market share,” said a Pragmatic expert.

Every company needs to increase their revenue, that’s true. There are other ways they could have gone about doing that wouldn’t alienate their base.

If the listened to their market, they might find other options:

-

- Pay per view sporting events

- Additional fee for specialty content

- Purchasing or renting previously retired content

- Streaming parties as an add-on experience

Plus myriad options that could come out with additional market research and data.

Paid Sharing | The Launch

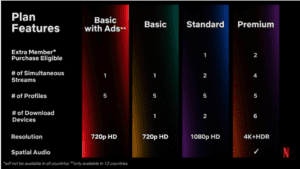

To address the account sharing problem, Netflix introduced a “paid sharing” trial in Chile, Peru and Costa Rica.

Under this trial, an account holder pays an extra $2.99 for a person outside the household to access the service. However, it’s still unclear how much that could cost in the U.S. (potentially anywhere from $2.50 to $4.50 for each account). And users must connect their viewing device to their home’s WiFi and watch something on Netflix at least once every 31 days.

Although the trial was accidentally launched across Netflix’s help center pages in other countries, the company quickly took down the information and updated the article to only apply to the three trial countries.

In a statement, Netflix said, “For a brief time yesterday, a help center article containing information that is only applicable to Chile, Costa Rica and Peru went live in other countries. We have since updated it.”

Netflix could have launched in their test markets more quietly to understand better how the broader market might respond. Additionally, they seem to have failed to prepare their sales and customer service teams with sufficient training, creating confusion in the market, which is the last thing you want in the middle of a launch.

In an attempt to help people add sub-accounts or transition to their own accounts, the company gave subscribers the ability to convert user profiles into new accounts and a dashboard to let users log out of devices remotely.

In the first three months of 2023, Netflix expected to roll out paid sharing in other countries.

Netflix also said, “From our experience in Latin America, we expect some cancel reaction in each market when we roll out paid sharing, which impacts near-term member growth. But as borrower households begin to activate their own standalone accounts and extra member accounts are added, we expect to see improved overall revenue, which is our goal with all plan and pricing changes.”

The enforcement of these paid-sharing fees is less clear now than in Netflix’s previous language about account sharing. The current policies hinge on a user’s account’s “primary location” and the devices connected to the Wi-Fi network.

The company uses the IP address from the Netflix device or app to determine the device’s general location. The main account holder will have to set the primary location, and if they don’t, the service will automatically set one based on IP address, device IDs and account activity.

However, the company has not specified how it will enforce these restrictions against watching Netflix from a different household. And Netflix’s help center states that the company doesn’t collect GPS data to determine the precise physical location of a device.

The Market Response

So far, the market is pushing back against the new paid-sharing plans. Specifically, people are expressing frustration and confusion.

- What are the rules when someone frequently travels or stays in different locations for long periods of time?

- How do you comply with the 31-day rule if your account is on multiple devices?

- What does this mean for college students, elderly parents, those who travel for a living or families living in more than one location per year?

Is Netflix the Next Blockbuster?

We all know Netflix played a pivotal role in Blockbuster’s decline and eventual bankruptcy. But if we look back, several key factors lead to Blockbuster losing its customer base.

- Blockbuster increased its late fees. That earned the company nearly $800 million, but at the cost of frustrating its customers.

- The company couldn’t keep up with the technology and convenience offered by its biggest competitors, Netflix and Redbox. The company tried to compete by offering its online rental service, but it was too little too late. Blockbuster was already facing declining revenue and high debt levels, and the new venture only added to its financial problems.

- At its peak, the company had accumulated significant debt, primarily through investments in new stores and technology and expensive marketing campaigns. The company’s large debt load made it difficult for Blockbuster to adapt to changes.

Ultimately, Blockbuster failed to listen to the market because they were too focused on their traditional business model of renting physical DVDs and Blu-rays. They were slow to adapt to the changing market and the shift towards online streaming services.

Now there is only one Blockbuster store in Bend, Oregon. They just released their first commercial in a “really, really long time.”

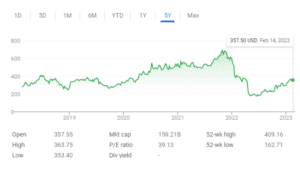

It is difficult to predict the future of any company, but failing to listen to the market will always have consequences. Netflix began trending on TikTok and Twitter, where users expressed their frustrations. And the stock took a hit since its peak in October 2021 ($630.31), and it’s currently trading at $357.50, as of February 14, 2023.

Blockbuster didn’t see streaming as a threat until it was too late. Netflix isn’t looking around at their competitors to see what problems are solving and they are not doing their own market research.

“Netflix defeated Blockbuster by listening to the market. There was a need to have easier access to entertainment. Now, they think they know their market so well they don’t have to listen anymore, but the market is always changing. Other streaming services should look at this whole situation as a cautionary tale,” said one Pragmatic expert.

Learn How to Become Truly Market-Driven with These Pragmatic Courses:

Foundations

This course will teach you how to gain a deep understanding of the market and the challenges it faces. With this knowledge in hand, you can start building and selling products that people actually want to buy. You’ll also learn how to master the Pragmatic Framework.

Insight

Learn how to turn data into actionable insights that drive successful product decisions. With Insight, you’ll gain a deep understanding of how to identify patterns within your data to prioritize the problems you should be solving. This grounded and actionable approach will enable you to employ a scalable and repeatable process for all your data projects, making it easier to strengthen your roadmaps, go-to-market plans, presentations and more.

Launch

Unleash the full potential of your organization with Pragmatic’s Launch course. Get the tools and training you need to execute successful launches and align your team around the same strategies and goals.

Author

-

The Pragmatic Editorial Team comprises a diverse team of writers, researchers, and subject matter experts. We are trained to share Pragmatic Institute’s insights and useful information to guide product, data, and design professionals on their career development journeys. Pragmatic Institute is the global leader in Product, Data, and Design training and certification programs for working professionals. Since 1993, we’ve issued over 250,000 product management and product marketing certifications to professionals at companies around the globe. For questions or inquiries, please contact [email protected].

View all posts