.

Editor’s Note: Alan Armstrong unexpectedly passed away on Aug. 16, 2019. A LinkedIn tribute to Alan from his staff emphasized his passion for placing the customer at the center: “Alan saw buyers as heroes of their own journey, and his spirit of inquiry brought dignity to their stories and decisions. His legacy will live on as we enrich our ability to listen and understand each other’s stories.” Pragmatic Institute extends its deepest sympathies to Alan’s family—both at home and at Eigenworks.

Pia, a product manager at a B2B SaaS company (let’s call it Flyer), was facing a lot of noise about pricing.

The sales team was complaining that the product was hard to sell because it was expensive and missing a key feature. Customers were churning at an accelerating rate. Senior leaders were murmuring about canceling Pia’s product altogether.

Pia knew her team of developers could be pulled at any minute and, if that happened, all her plans for new features and packaging would fly out the window. She had to get to the heart of the pain her customers were feeling.

She dug in and examined the customer data she had available: user analytics, event reports, reason codes in the CRM, stories relayed by the sales and customer success teams. But none of it brought her closer to the truth.

Analytics data revealed what had happened, not why. The CRM reasons were too simple. The sales team provided anecdotes rather than evidence. And really, Pia realized, it was unfair to expect sales reps to know exactly why they lost deals. Relying on their interpretations might shed some light but, at worst, their “findings” could be actively misleading.

Everyone had their own opinion … but Pia didn’t want opinions. She wanted facts.

Have you been in Pia’s shoes? How do you, as a product professional, get insights into your customers and their buying decisions throughout the product life cycle? I’ve long been passionate about understanding buyers by listening to their stories. And yes, that means picking up the phone and having actual conversations!

For product managers, listening to buyers gives you authority for influencing the product roadmap. Those conversations with customers are critical all the way through the product life cycle, from launch and growth to maturity and decline. The more conversations you have, the more reliable the insights.

But here’s the challenge: When you conduct a lot of buyer interviews, how can you see themes and patterns in all that text? It’s easy to understand the themes of a single interview, but it’s a lot harder to understand themes across 20 interviews.

However, understanding story data in aggregate can give you a way to organize your buyer stories and insights. To illustrate, let’s go back to Pia, whose story is based on how Eigenworks analyzes buyer decisions.

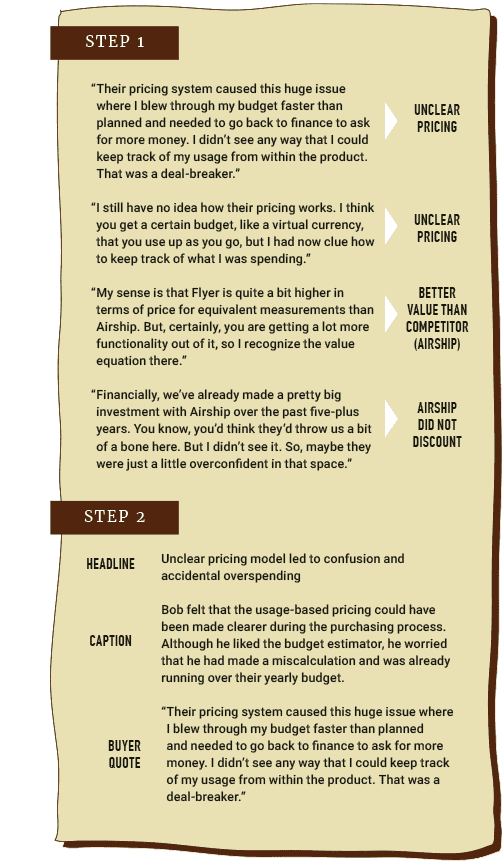

Step 1: Consider Quotes, Identify Themes

Pia called several of her customers and talked to them about price. Yes, it took time, but the conversations were informative, and people appreciated her interest. They said they valued the opportunity to talk through their decision-making and have their voices heard.

Pia then took the text of those interviews and applied a structure to it. This allowed her to isolate key themes and insights for cross-comparison.

Step 2: Identify One Nugget of Insight

Next, Pia wrote a succinct headline for each quote and a longer caption to explain it. She called this grouping of headline-caption-quotes a “nugget.” Each nugget represented a core insight into the buyer’s decision.

Step 3: Code the Nuggets

Once she had her nuggets, Pia assessed the emotional value of the quotes and tagged them as a “rant” (strongly negative), “rave” (strongly positive) or “positive,” “negative” or “neutral.”

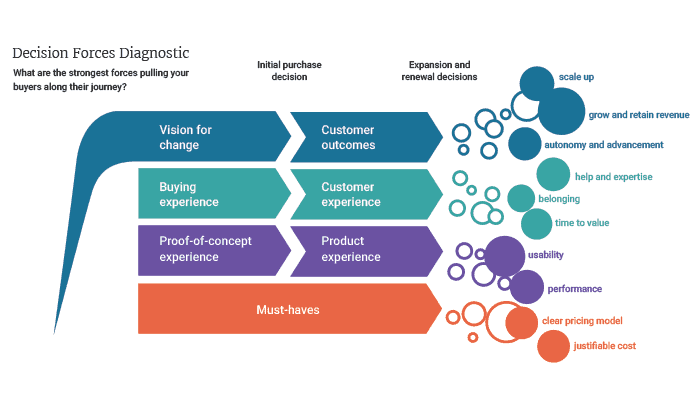

Next, Pia looked at what buyers wanted to achieve by using her product. She identified a set of decision forces that reflected these goals and influenced decisions.

One important note about this concept: Decisions are multifaceted and rarely boil down to a single factor. Many forces push and pull at your customers as they decide to buy, renew or churn. For example, your buyer might be moved by forces such as

- I want to scale up

- I want to retain revenue

- I want personal advancement

- I want to improve our time-to-value

- I want great product performance

- I want great customer service

- I want a justifiable total cost

Pia coded each nugget according to one or more forces, then assessed the strength of the force in each case. How important was it for the buyer? She coded importance, too.

Step 4: Group by Stage of the Buyer’s Journey

Pia considered where the forces came into play. She started grouping them by stage of the buyer’s journey—before and after the buying decision. She also grouped them by categories like customer outcomes, customer experience and product experience.

The resulting Decision Forces Diagnostic gave her a bird’s-eye view of buyer decisions and the forces that push and pull at them along the way. Each force played out all through the journey. For example, the help and expertise offered by the vendor was a force that affected the buying experience as well as the customer experience.

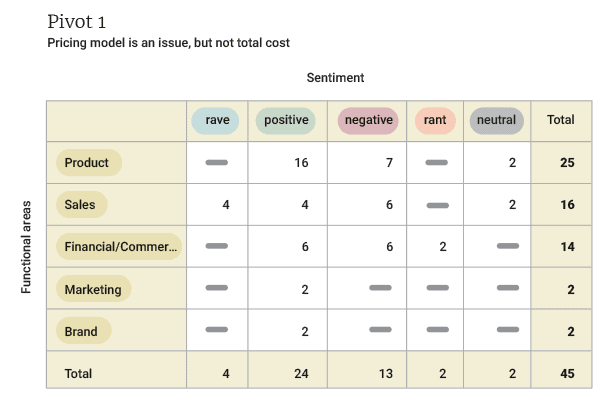

Step 5: Slice and Dice the Data

Finally, Pia placed the coded nuggets into a database and began slicing and dicing. When she filtered the information in the database by “price,” a surprising insight emerged.

There were six positive comments and six negative comments all related to price. Pia opened the cells of the positive comments and saw that customers considered the total cost fair. She then opened the negative comments and saw that people wanted to budget predictably, but were frustrated by the uncertainty of the pricing model.

Pia realized that customers weren’t upset by the total cost—some explicitly said it was fair! Her customers were unhappy with the pricing model, which was usage-based rather than flat-fee-based. Heavy usage caused a few customers to unexpectedly blow through their budgets and, naturally, they were upset. Pia was able to take this finding to her senior team.

That’s the value of talking to buyers and diagnosing their decisions. When you start looking at all the forces that push and pull at a decision, you get a new lens on what’s important to your buyers. In Pia’s case, it was an unexpected finding about pricing model vs. total cost.

Having found the heart of her customers’ pain, Pia could effect change across her company. Her decision analysis spurred changes in several areas

- Product realized the product was mispackaged—several discrete solutions were bundled, thus causing pricing stress. The product team looked at how it could break apart the solutions into individually lower-priced components.

- The customer success team began talking to customers to help them manage their spend. They helped customers focus on the most valuable features and turn everything else off.

- Design improved the budgeting tool by including a notification feature for usage.

Start with a Conversation

Pia’s journey through this process is loosely based on my own experience. Years ago, as a newly minted product manager, I was called into a meeting where everyone was asked to justify their spend. I had a team of 12 developers and a lot of exciting ideas for pricing and packaging. But the next day, my staff was cut to three.

Soon after, I attended Pragmatic Institute’s training and learned about win/loss analysis. I got on the phone with customers and brought this information to the next meeting with the senior team. Right away, I got my developers back and, over time, I was able to demonstrate the merit of my pricing and packaging ideas. This happened because I brought customer data to the table. I could tell user stories. It was powerful stuff! You can do this too. Talk to your buyers—they have so much to tell you.

What You Can Do Tomorrow

Talk to your customers. Yes, pick up the phone! You won’t solve customer’s problems by relying solely on user data. You need to have real conversations.

- Isolate a market segment to interview, as this will make your results more cohesive.

- Break interviews into nuggets of insight. Remember that a nugget is a fundamental component of insight that consists, in our practice, of a headline, a caption, and a buyer quote.

- Filter your nuggets into categories like “sentiment” (did the buyer rant, rave or express neutral feelings?) and “strength” (was this an important factor in the decision?).

- Assemble nuggets into a data structure that works for you. We use a platform called AirTable, but you could also just use a spreadsheet. Keep it simple.

- Use your database to slice and dice for granular views. For example, you could search for all of the raves related to your wins against Competitor X.

- Continually refine your database—it’s your catalog of evidence.

- Bring the evidence forward within your company to influence decisions and build a culture centered on the voice of your buyers.

Learn More

Certification Courses

Webinars

- Why Are We Winning? Why Are We Losing?

- The Eight Rules of Successful Win/Loss Analysis

- Discover Your Distinctive Competencies with Buyer Interviews

Articles

- Starting and Running a Win/Loss Program

- Competitive Intelligence Gathering Through Win/Loss

- Win/Loss Analysis Checklist for Product Managers

- Maintaining Momentum: 12 Tips for Interim CAB Calls

Blogs

Tools and Templates (Alumni Only)