Wayne, PA – July 11, 2022 – Renovus Capital Partners (Renovus) and Petra Capital Partners (Petra) announced today the sale of Pragmatic Institute (“Pragmatic” or the “Company”) to MidOcean Partners, a middle market private equity firm.

Founded in 1993, Pragmatic has become one of the world’s largest and most-respected product management training companies. Over the past 30 years, the Company has successfully trained more than 200,000 professionals in top tier corporations across over 40 countries. By implementing its unique “Pragmatic Approach Framework”, Pragmatic delivers cutting edge thought leadership via its world class team of trainers to create a company-wide language to drive excellence in the mission critical product management process. The Company’s training is so highly regarded that Pragmatic training is often stated as a specific skills requirement in product management talent searches.

Philip Alexander, CEO of Pragmatic Institute, said, “Renovus and Petra have been valuable board members and great partners to Pragmatic and to me personally. We built a strong relationship over the past four years in our collective efforts to build a best-in-class company.”

Jesse Serventi, Founding Partner of Renovus, said, “The investment in Pragmatic was built on our conviction in the value proposition of what good product management can do for corporate enterprises, combined with our view that Pragmatic had established the brand and content base to execute on the market opportunity. Hiring Phil and building out the management team with him enabled Pragmatic to execute on the opportunity and achieve a great result for all stakeholders.”

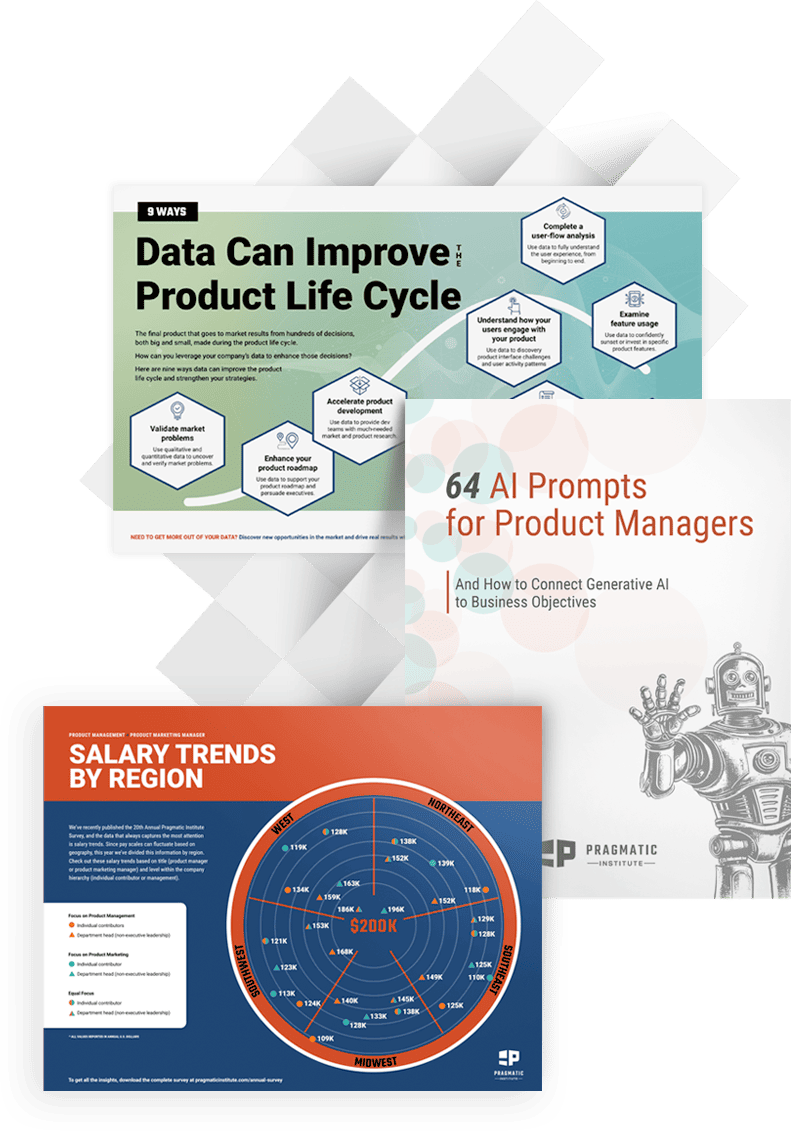

“Under our ownership, Pragmatic went from being a provider of six in person product management courses to a provider of nearly twenty courses delivered in person and online across product, data science, and design management, supported by a vibrant online alumni community,” noted Doug Owen, Partner of Petra Capital. “We are proud of the Pragmatic team and look forward to tracking their future success.”

William Blair served as financial advisor, and DLA Piper acted as legal advisor to Pragmatic Institute. Gibson Dunn & Crutcher LLP acted as legal advisor to MidOcean.

About Pragmatic Institute

Formerly known as Pragmatic Marketing, Pragmatic Institute is one of the world’s largest and most-respected product, design and data training companies. Pragmatic offers a variety of courses focused on professional training and certification of product managers, marketers and designers across multiple geographies and course delivery modalities. The “Pragmatic Approach” has been the defining aspect of the Company’s course offerings, yielding great professional success for the deep alumni base of Pragmatic learners. For more information, please visit: https://www.pragmaticinstitute.com/

About Renovus Capital Partners

Founded in 2010, Renovus Capital Partners is a lower middle market private equity firm specializing in the Knowledge and Talent industries. From its base in the Philadelphia area, Renovus manages over $1 billion across its three sector focused funds and other strategies. The firm’s current portfolio includes over 20 U.S. based businesses specializing in education and training, healthcare services, technology services and professional services. Renovus typically partners with founder-led businesses, leveraging its experience within the industry and access to debt and equity capital to make operational improvements, recruit top talent, pursue add-on acquisitions and oversee strategic growth initiatives. More information can be found at www.renovuscapital.com

About Petra Capital Partners

Petra Capital Partners is a private equity firm engaged in providing growth capital for companies located throughout the United States. Our investment team has an established track record of success spanning over 20 years and deploying more than $700 million of capital invested into more than 100 companies. The firm is seeking investments for its current SBIC fund, Petra Growth Fund IV. Petra can invest up to $20 million per company in equity or debt securities with a primary focus on backing high growth business services, tech-enabled services and healthcare services companies. More information can be found at www.petracapital.com.